Share!

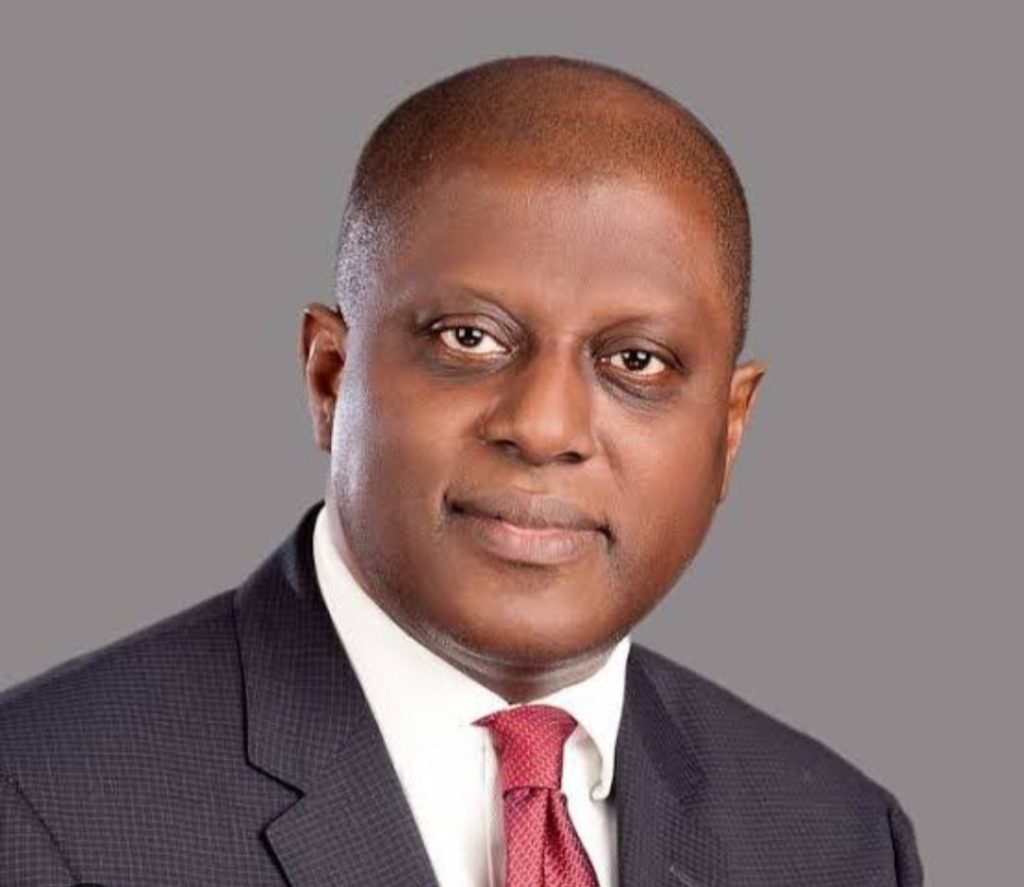

The Governor of the Central Bank of Nigeria, Dr Olayemi Cardoso, has said that Nigerians are facing the consequences of excess money supply into the economy, citing the N27tn Ways and Means loan and N10.5tn interventions of the past administration.

Cardoso said this at the BusinessDay CEO Forum which was held in Lagos on Thursday.

He said, “Interest rate is not set by the governor of the Central Bank. The interest rate is set by the members of the monetary policy committee. Thankfully, we have a monetary policy committee composed of independent-minded people who are solely driven by data.

“The MPC has made it very clear that for them the major issue is taming inflation and has also made it very clear that they will do whatever is necessary to tame inflation. Sadly, we have a situation where a lot of money supply went into the system. We all saw Ways and Means soar to N27tn. We saw interventions of N10.5tn. It has its consequences. In large respect, that is what we are paying for now.”

Ways and Means is the money that the Central Bank of Nigeria lends to the Federal Government in the meantime to augment spending based on the time the revenue is generated.

This is not the first time that the CBN governor has lamented about the effects of the ways and means as well as the intervention funds.

At the end of the first MPC meeting held this year, Cardoso said, “The interventions that took place in the recent past were estimated in excess of N10tn. I am not talking about ways and means; I am talking about the interventions. What was the budget of the Federal Government of Nigeria? What was the budget of the largest state in Nigeria? Do the math, and it will tell you the extent of damage.”

Since then, the CBN governor had announced a suspension of the intervention programmes, saying the apex bank was going to refocus on its primary duty of price stability and adoption of orthodox measures to achieve its aim.

Also, Cardoso has said that the apex bank would no longer give Ways and Means to the President until the previous loans are repaid.

Under the previous administration, the then CBN governor, Godwin Emefiele, without approval from the National Assembly, allegedly printed the sum of N22.7tn for former President Muhammadu Buhari under Ways and Means.

On the hikes in the interest rate, Cardoso said the MPC was working to stabilise the economy with its decisions.

“If these hikes were not done when they were done, if you recall naira to the dollar was almost tipping over. This helped to stabilise things. It’s a timing issue,” he added.

As of the last MPC meeting, the rate was hiked by 150 points to 26.25 per cent.

Already, experts are projecting further increase albeit at a slower rate.

Related posts:

- CBN Assures Investors Willing To Repatriate Funds Of Their Money Amid Crude Oil Revenue Drop

- Traders, Supermarkets, Others Begin to Reject Old Naira Notes ahead of CBN Deadline

- Naira redesign: Bank operators Kick over CBN alleged hoarding of new notes

- Old notes: Cash crunch worsens as Nigerians wait on Buhari