Share!

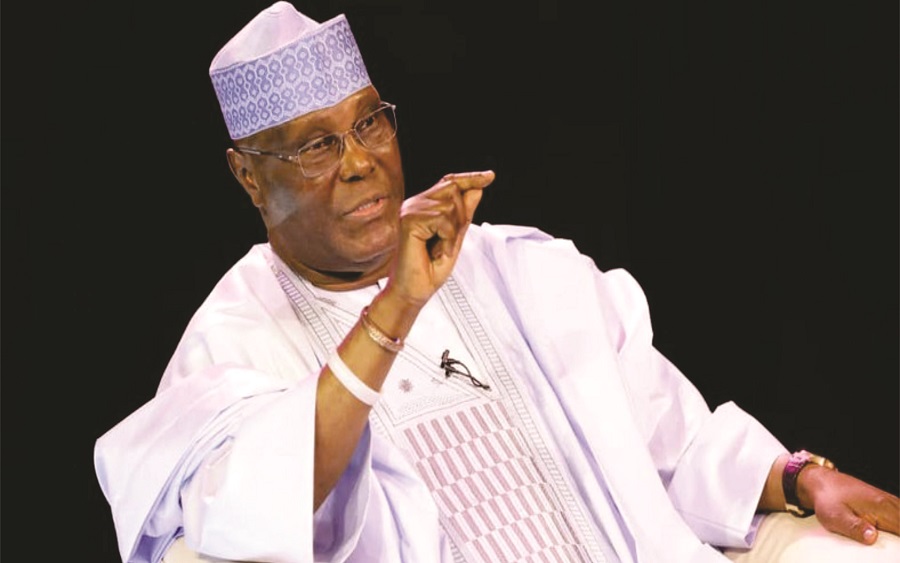

President Bola Tinubu’s foreign exchange policy has drawn criticism from former vice president, Atiku Abubakar, who claims that the policy’s hasty implementation and lack of careful planning have caused the nation to experience multiple economic crises.

Abubakar claimed on his X (formerly Twitter) account that the nation’s foreign exchange policy was to blame for various forms of poverty and economic hardship.

At a meeting called at his instance on Thursday to address the Foreign Exchange crisis and the problem of economic downturn, among others, Bola Tinubu failed, yet again, to showcase any concrete policy steps that his administration is taking to contain the crises of currency…

According to Atiku, the government did not allow the Central Bank of Nigeria (CBN) to develop implement a sound FX management policy that would have dealt with such issues as increasing liquidity, regulating demands as well as rate convergence.

The PDP presidential candidate in the general election said that the current government should be willing to open itself to sound counsels from opposition and ask for help in fixing the economy.

Atiku said, “The Government did not allow the CBN the independence to design and implement a sound FX Management Policy that would have dealt with such issues as increasing liquidity, curtailing/regulating demand, dealing with FX backlogs and rate convergence.

“I firmly believe that if and when the Government is ready to open itself to sound counsels, as well as control internal bleedings occasioned by corruption and poorly negotiated foreign loans, the Nigerian economy would begin to find a footing again.”

Furthermore, the former vice president offered some possible solutions that can address the burgeoning foreign exchange crisis in the country.

According to him, the government can implement a managed-float policy rather than a free-float FX regime.

Atiku further stated that the government needs to bolster its foreign exchange reserve to promote liquidity in the market.

“Nigeria’s major challenge is the persistent FX illiquidity occasioned by limited foreign exchange inflows to the country. Without sufficient FX reserves, confidence in the Nigerian economy will remain low, and Naira will remain under pressure. The economy will have no firepower to support its currency.

Related News

Police nab 5 suspects for diverting bags of wheat belonging to UN World Food Programme

Inflation: Corps members allege hunger in orientation camps

PDP will win Edo guber election – Expert

“On the other hand, given Nigeria’s underlying economic conditions, adopting a floating exchange rate system would be an overkill. We would have encouraged the Central Bank of Nigeria to adopt a gradualist approach to FX management. A managed-floating system would have been a preferred option.

“In simple terms, in such a system, the Naira may fluctuate daily, but the CBN will step in to control and stabilize its value. Such control will be exercised judiciously and responsibly, especially to curve speculative activities,” Atiku advised.

No related posts.